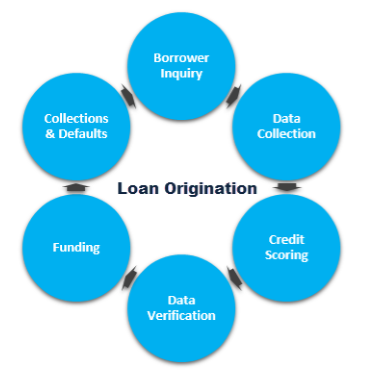

The competition in loan origination services is expanding more than ever, making it essential to process customer requests quickly and efficiently. However, manual origination and decision making processes take too much time and expense, and increase the risk of non-compliance. Lending companies need unified solutions which can accelerate loan origination systems from start to finish.

Second Foundation’s loan origination and risk management services enable banking organizations to streamline, automate, and speed up the loan lifecycle process, and deliver an outstanding experience to your customers.

Second Foundation, through its expertise in transactional technology strategy, enables you to handle a high volume of loans efficiently, increase compliance and accelerate decision making processes. Our customers are able to quickly and seamlessly adopt an automated approach to loan origination and risk management services, along with compliance through Regtech. They are able to focus on their core competencies, achieving a faster ROI on their technology investment.

- Loan Applications

- Functional Origination

- Underwriting Automation

- Risk and Scoring Models

- Streamlined lending process

- Better regulatory compliance

- Enhanced customer experience and satisfaction

- Mitigation of risk through better decision making

- Reduced error rate and costs

- Less back office workload